what is fit tax on paycheck

Youd pay a total of 685860 in taxes on 50000 of income or 13717. But you must itemize in order to deduct state and local taxes on your federal income tax return.

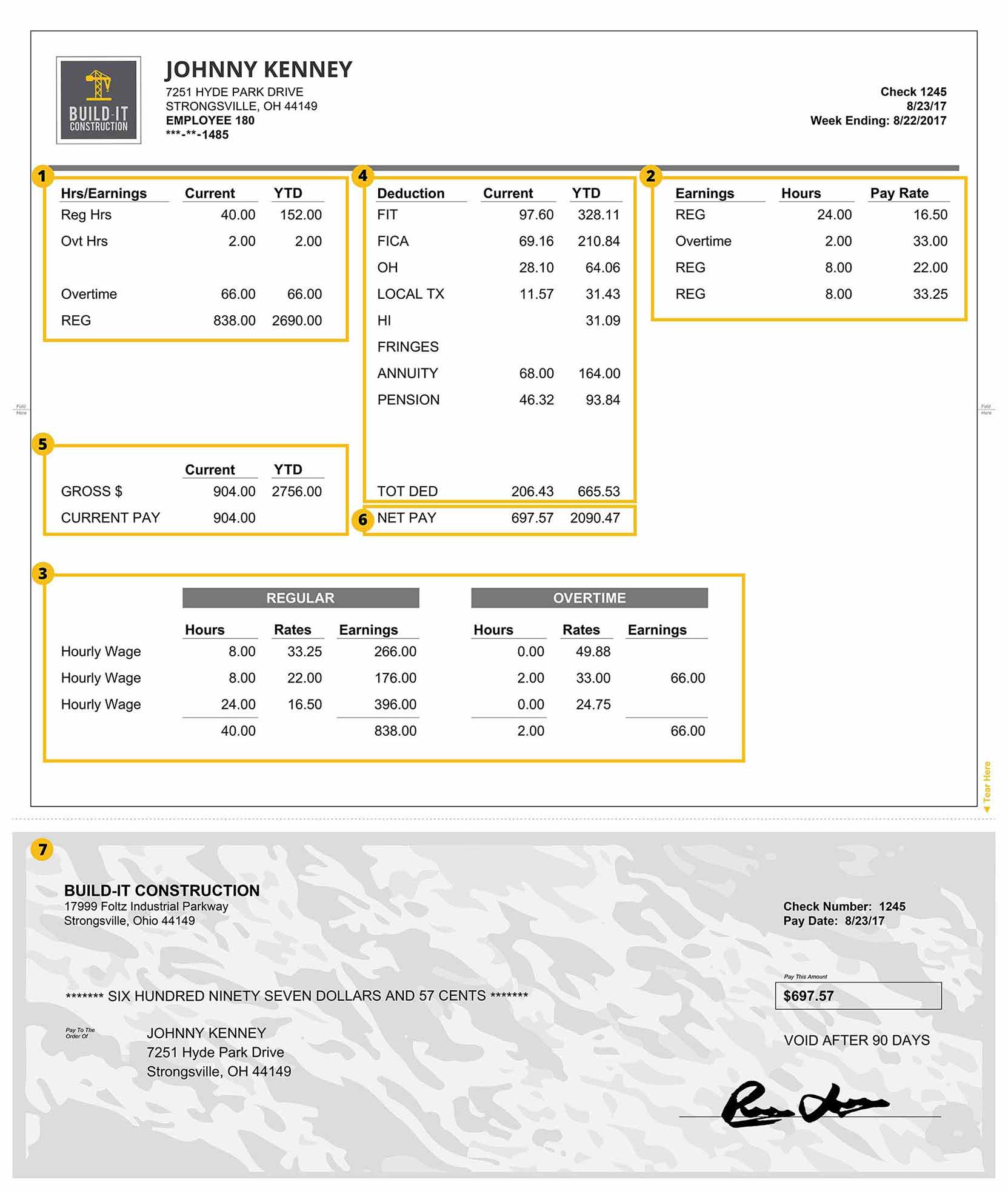

How To Calculate Taxes On Paycheck Sale Online 54 Off Www Ingeniovirtual Com

It depends on.

. The amount of FIT withholding will vary from employee to employee. If you see the fit deduction listed on your paychecks earning statement it is an acronym for federal income tax. 10 12 22 24 32 35 and 37.

Employers use the information an employee provides on their completed and signed Form W-4 the amount of the employees taxable earnings and the frequency the. You should calculate an employees federal income tax withholding with their Form W-4. Your bracket depends on your taxable income and filing status.

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. For employees withholding is the amount of federal income tax withheld from your paycheck. Estimate your federal income tax withholding.

Ad Try the Online Payroll Software That Saves You Time and Easy To Track Every Payday. 3657 Which is correct 4. If you earn at least a specified amount for at least 40 quarters you can get Social Security benefits when.

Backup withholding rate remains 24. Personal income tax is collected from individuals or entities. 22 on the last 10526 231572.

What Is Fit Tax On Paycheck. Fit stands for Federal Income Tax Withheld. Second the 2017 law capped the SALT deduction at 10000 5000 if.

FICA taxes are commonly called the payroll tax. Each allowance you claim reduces the amount withheld. Federal Income Tax or FIT is the amount withheld from an employees paycheck which goes toward their Federal Income Tax liability at the end of the year.

The next dollar you earn is taxed at 22. Federal income tax and FICA tax. How much you can expect to come out of your paycheck in.

FICA stands for Federal Insurance Contribution Act. For example a single employee making 500 per weekly paycheck may have 27 in federal income tax withheld per paycheck in 2021 if the employer uses the wage bracket method for standard. To calculate federal income tax.

Your employer uses the data in your IRS filing sheet to determine how much of your pay to withhold. When you file your tax return annually on or before the April filing deadline you are reconciling the amount of taxes you have. Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate.

The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare. Social Security and Medicare. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages.

This amount is based on information provided on the employees W-4. Employers withhold FIT using either a percentage method bracket method or alternative. See how your refund take-home pay or tax due are affected by withholding amount.

How many withholding allowances you claim. Federal Income Tax Withheld. These are the rates for.

If you withhold at the single rate or at the lower married rate. FIT is the amount required by law for employers to withhold from wages to pay taxes. FICA taxes consist of Social Security and Medicare taxes.

FIT tax is calculated based on an employees Form W-4. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. This tax includes two separate taxes for employees.

The FIT deduction on your paycheck represents the federal tax. What is fit tax on paycheck. Your effective tax rate is just under 14 but you are in the 22 tax bracket.

How much is FIT tax. What is the fit tax rate for 2020. Supplemental tax rate remains 22.

There are seven federal tax brackets for the 2021 tax year. However they dont include all taxes related to payroll. How Your Paycheck Works.

There are also rate and bracket updates to the 2021 income tax withholding tables. Use this tool to. The issue is with the data in 4.

FIT taxes are the income taxes that you pay to the federal government. This is true even if you have nothing withheld for federal state and local income taxes. How It Works.

The amount of income tax your employer withholds from your regular pay. Federal income tax FIT is withheld from employee earnings each payroll. Get Access To Unlimited Payrolls Automatic Tax Payments Filings and Direct Deposit.

Is fit the same as federal withholding. Fidelity has a form for filing taxes called FORM 1099-B. The amount of income you earn.

Your net income gets calculated. How much you can expect to come out of your paycheck in.

Become Productive With Monthly Budget Templates Budgeting Monthly Budget Financial Planning Budget

Paycheck Budget Planner Printable Sheetsmonthly Bill Planner Etsy Budget Planner Printable Printable Planner Printable Stationery

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Etsy Product Cost Calculator Google Sheets Labor Costs Etsy Google Sheets Pricing Calculator Cake Pricing Calculator

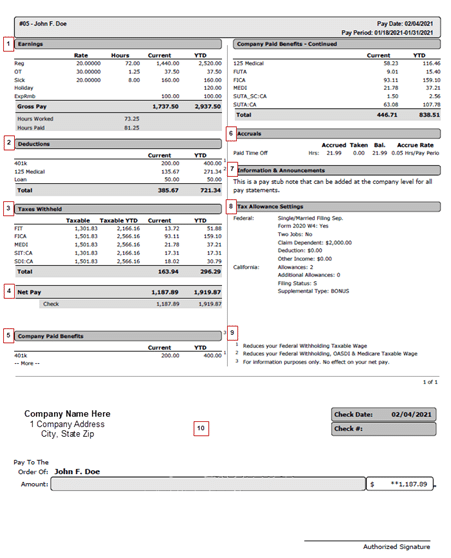

A Guide On How To Read Your Pay Stub Accupay Systems

How To Calculate Taxes On Paycheck Sale Online 54 Off Www Ingeniovirtual Com

Business Order Form Invoice Printable Sheets Etsy In 2022 Printables Invoicing Budget Printables

How To Calculate Taxes On Paycheck Sale Online 54 Off Www Ingeniovirtual Com

How To Calculate Taxes On Paycheck Sale Online 54 Off Www Ingeniovirtual Com

Federal Income Tax Fit Payroll Tax Calculation Youtube

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Excel Paycheck Budget Templateexcel Gift Finance Giftbudget Etsy Video Video Budgeting Budget Spreadsheet Template Monthly Budget Template

Free 8 Sample Medical Invoice Templates In Ms Word Pdf Invoice Template Bill Template Medical Billing

Understanding Your Pay Statement Innovative Business Solutions

Breaking The Cycle Of Living Paycheck To Paycheck Money Management Personal Finance Budget Budgeting

Different Types Of Payroll Deductions Gusto