credit card length of time

In that case should receive a decision in the mail in 7-10 business days after applying. We bought some jewelry paid it off over the course of several months never missing a.

Does Having Credit Cards With A Zero Balance Hurt Your Credit Score Fox Business

Typically the longer a person has had credit the higher their credit score will be granted they dont have a history of late payments maxed-out balances or other negative.

. I dont think that means AAOA cause right now my AAOA is at about 33years and thats after I app spreed and picked up 4 new cards end of Sept. Lets check it out. 500 1000 Average credit card approval rating for.

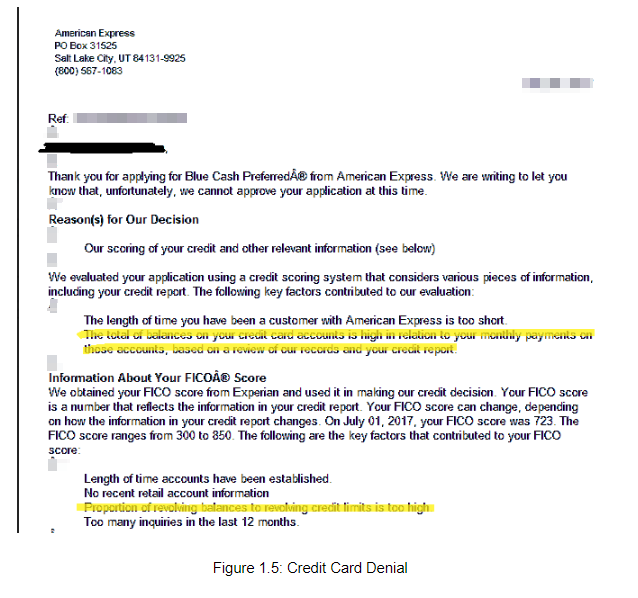

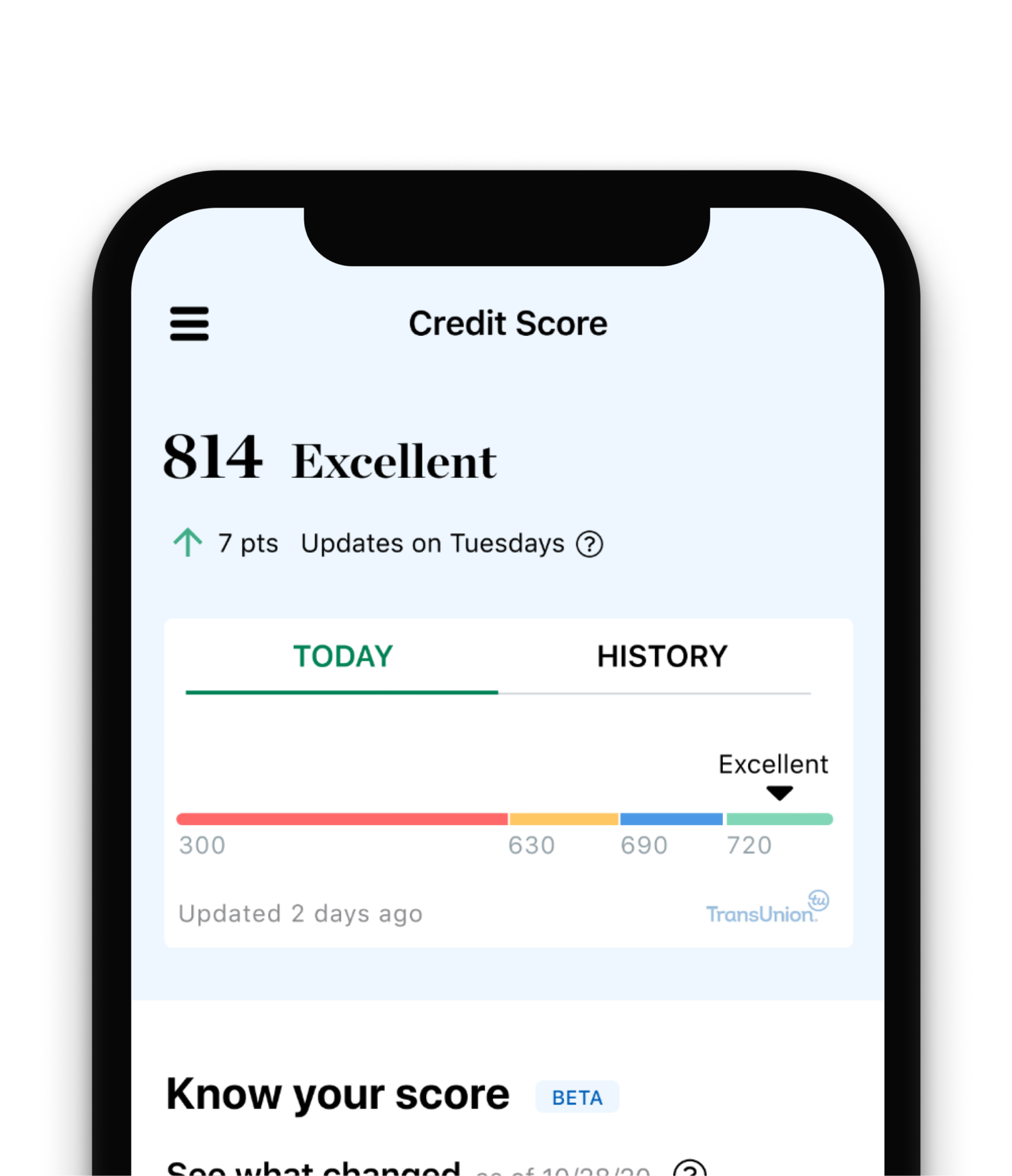

In a FICO Score High Achievers study people with a FICO Score ranging from 800-850 had an average length of credit history of 99-128 months around 8-11 years. Average length of time it takes to get approved for a credit card. Chargeback Timeframes and Reasonings Visa and Mastercard Consumers.

While age-related factors can impact your credit scores. The number of new credit. Even some people who havent had credit for a considerable length of time can still have a high FICO Score if the rest of their credit report looks good.

The length of your credit history or how long youve been using credit typically accounts for 15 percent of your total credit score. Accounts you didnt pay like a charged-off credit. Consumers with a limited.

If you havent heard back after 10 business days then give customer service a call at. 7 hours agoWhen looking for a 0 APR credit card the length of the introductory offer is one of the most important factors to consider. Your credit score can drop more than 100 points which.

The card issuer must send you a letter stating that it has received your billing dispute within 30 days of receiving it. Many credit card companies will agree to do so if your payment history was stellar up until the misstep. So my husband has a Helzberg Diamonds credit card Comenity Bank with a 1000 credit limit.

A longer credit history will always have. However if you need a loan or see a great credit card offer dont let length of credit history keep you from applying. If you miss even one payment on your credit card here are four terrible horrible no good very bad results you may face.

While it isnt the most important factor used. The card issuer must complete its investigation within. You should look at your credit card issuers specific timelines before proceeding.

30 days or less Average first-time credit limit. A credit card grace period is a length of time during which you can charge purchases to your card and wait to pay for them without being charged interest.

How Having Multiple Credit Cards Affects Your Credit Score

How Long Does It Take To Get A Credit Card 2022

7 Guaranteed Approval Credit Cards With No Deposit 2022

Most Common Credit Card Terms And Definitions

How Long After Opening Your First Credit Card Will Your Score Be Created Nextadvisor With Time

How To Improve Your Credit Age Of Credit History Credit Com

A Guide To Understanding The Numbers On Credit Debit Cards Pointcard

Surprising Hidden Secret Of Credit Card Bitnine Global Inc

Length Of Credit History An In Detail Guide

How Long Do Credit Card Companies Keep Records Of Purchases

When Were Credit Cards Invented The History Of Credit Cards Forbes Advisor

Length Of Credit What It Means And How It Affects 15 Of Score

How Long To Wait Between Credit Card Applications Forbes Advisor

How Bad Is It For Your Credit Score To Close A Credit Card Account Quora

How To Improve Your Credit Age Of Credit History Credit Com

How Long Should I Wait Between Credit Card Applications Nerdwallet

.png)